As crypto emerges and ever Investor is looking out for the gold coin, Aerodrome Finance (AERO) has earned the reputation of investors and analysts. Maybe because it offers differences to a large extent, well, it has become a topic of discussion for its potential growth in the coming years. Let’s discuss this growth ourselves..

Current Market Overview

From the last data we had, Aerodrome Finance has shown a promising trend with a current price of $1.17, despite a slight decrease of -1.96% in the last 24 hours. So sentiment still remains good, although the subsequent weeks has offered +3.77%, indicating a resilient performance amidst market fluctuations.

Table 1: Current Market Overview of AERO)

| Metric | Value |

| Current Price | $1.17 |

| 24-hour Change | -1.96% |

| Weekly Change | +3.77% |

| Market Sentiment | Positive |

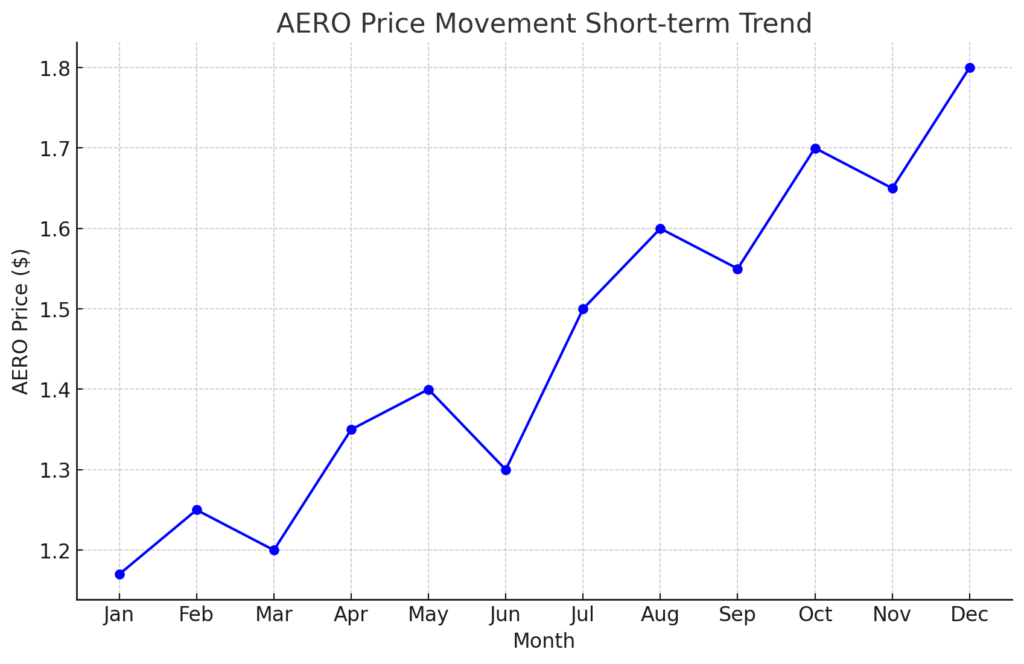

Short-term Trajectory

For short term investors, Aerodrome Finance is expected to experience volatility, which is normal. However, the coin seems to be designed to gro. Although steadily with a potential surge to $5.35 by 2025.

2024 Price Prediction

As the year unfolds, we have various sources as their predictions for AERO. Blockchainreporter says Aerodrome Finance could achieve a minimum price of $1.21, potentially reaching a peak of $1.43, with an average trading price hovering around $1.26 for the year. Bitscreener projects a more optimistic scenario where AERO could attain a maximum of $3.61, accompanied by a potential minimum of around $0.07958 during the same year.

(Table 2 here: 2024 AERO Price Predictions)

| Prediction Source | Minimum Price | Average Price | Maximum Price |

| Blockchainreporter | $1.21 | $1.26 | $1.43 |

| Bitscreener | $0.07958 | N/A | $3.61 |

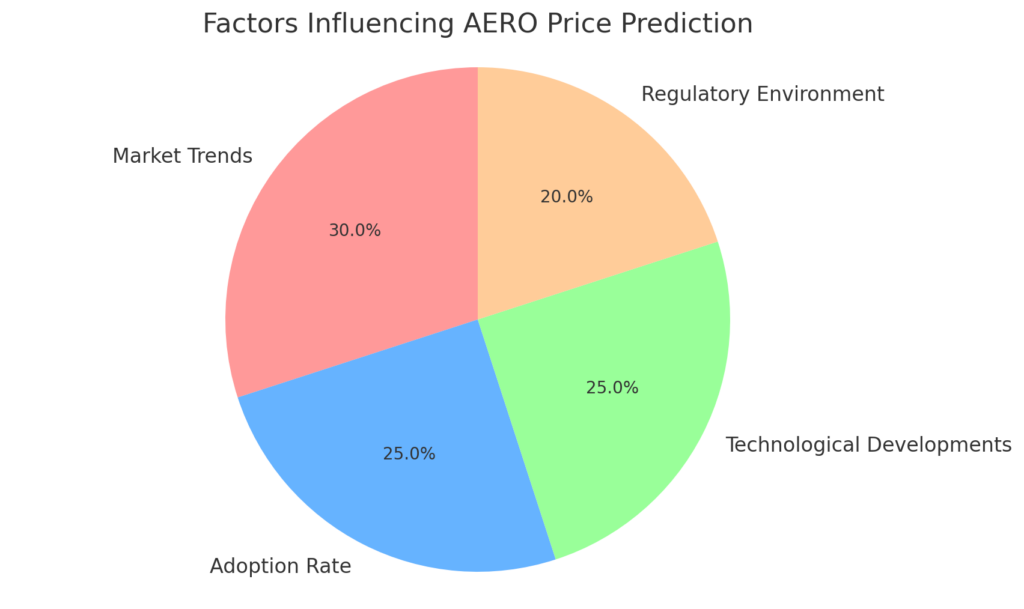

Factors Influencing the Prediction

Several factors contribute to these predictions, including Market Trends, i.e the market direction of general cryptocurrency will eventually affect the AERO’S price. Also, Adoption Rate leads to more accumulated which of course, cab significantly impacts positively the price of the coin. Additionally, Technology or Regulation can both impact either negatively or positively the coin.

Aerodrome Finance (AERO) Price Prediction: 2024, 2025, 2030

Current Market Overview

- Market Cap: $563,638,919

- Total Volume: $18,611,339

- 24-Hour Change: +0.45%

- 7-Day Change: +8.07%

Short-term Trajectory

- Current Price: $1.18

- All-Time High (April 2024): $2.31

- Support Levels: $0.60, $0.94

- Resistance Levels: $2.00

For short-term investors, Aerodrome Finance is expected to experience volatility, with predictions suggesting an average price ranging from $0.96 to $1.11 in early June 2024.

(Insert Chart 1: AERO Short-term Price Movement)

2024 Price Prediction

- Most Bearish Scenario: $0.53 to $0.79

- Average Price: $0.66

Monthly Predictions

| Date | Avg Price | Lowest Price | Highest Price |

|---|---|---|---|

| 1 June 2024 | $1.04 | $0.96 | $1.11 |

| 2 June 2024 | $1.04 | $0.96 | $1.11 |

| 3 June 2024 | $1.00 | $0.93 | $1.07 |

| 4 June 2024 | $0.97 | $0.90 | $1.04 |

| 9 June 2024 | $0.79 | $0.74 | $0.85 |

| 14 June 2024 | $0.66 | $0.61 | $0.70 |

| 24 June 2024 | $0.49 | $0.45 | $0.52 |

| July 2024 | $0.46 | $0.43 | $0.49 |

| August 2024 | $0.50 | $0.47 | $0.54 |

| September 2024 | $0.54 | $0.50 | $0.58 |

| October 2024 | $0.58 | $0.54 | $0.62 |

| November 2024 | $0.62 | $0.58 | $0.67 |

| December 2024 | $0.66 | $0.61 | $0.71 |

(Insert Chart 2: AERO 2024 Monthly Price Prediction)

Long-term Predictions

2025 to 2035 Price Forecast

| Year | Avg Price | Lowest Price | Highest Price |

|---|---|---|---|

| 2025 | $2.03 | $1.62 | $2.43 |

| 2026 | $2.66 | $2.12 | $3.19 |

| 2027 | $3.48 | $2.78 | $4.17 |

| 2028 | $4.56 | $3.65 | $5.47 |

| 2029 | $5.97 | $4.78 | $7.16 |

| 2030 | $7.82 | $6.26 | $9.38 |

| 2031 | $10.24 | $8.20 | $12.29 |

| 2032 | $13.42 | $10.74 | $16.10 |

| 2033 | $17.58 | $14.06 | $21.10 |

| 2035 | $30.17 | $24.14 | $36.21 |

(Insert Chart 3: AERO Long-term Price Prediction)

Technical Analysis: Key Indicators

- Support and Resistance Levels:

- Support: $0.60, $0.94

- Resistance: $2.00

- Market Sentiment:

- Slightly bearish as of May 2024.

- Predictive Forecasts:

- AI/ML models predict substantial growth with an average price of $130 by 2030, potentially exceeding $1,000 by 2033.

(Insert Chart 4: AERO Technical Analysis Overview)

Market Sentiment Analysis

The Fear & Greed Index and Sentiment Analysis help in understanding the market mood towards AERO. Currently, the sentiment is cautiously optimistic with a slight bullish trend.

- Fear & Greed Index:

- Current state: Neutral to Greed.

- Sentiment Analysis:

- Positive sentiment is increasing, which could drive the price higher.

(Insert Chart 5: Fear & Greed Index Over Time)

Conclusion

While price predictions are speculative and subject to market fluctuations, Aerodrome Finance shows potential for growth in both the short and long term. Investors are advised to monitor market trends, technological developments, and regulatory changes before making investment decisions.

Disclaimer

These predictions are based on AI/ML models and should not be taken as investment advice. Always conduct thorough research and consider the inherent risks in cryptocurrency investments.

For the most current updates and detailed predictions, refer to reputable sources and analytical reports.

This comprehensive analysis provides a detailed overview of AERO’s potential future performance, helping investors make informed decisions.

Conclusion

While price predictions are speculative and subject to change due to the volatile nature of cryptocurrencies, Aerodrome Finance shows potential for growth in 2024. Investors are advised to conduct thorough research and consider market trends, technological advancements, and regulatory changes before making investment decisions.

Remember, investing in cryptocurrencies involves risk, and it’s essential to invest only what you can afford to lose. For the most current and detailed predictions, please refer to the latest reports and analyses from reputable sources.